SINGAPORE IP AND FIRMS' PERFORMANCE STUDY

This study was done to understand the impact of Intellectual Property Rights (IPRs) on firms’ performance in Singapore, in particular the impact of IPRs on firms' revenue and profitability.

The Singapore IP and Firms’ Performance study seeks to understand the impact of IPRs on firms’ performance in Singapore. Using firm-level financial and manpower administrative data made available via various Singapore governmental databases,

this study examines the impact of IPRs on firms’ revenue and profitability. The Singapore study adds to existing data and insights contributed by other international studies.

The study findings suggest that ownership of IPRs supports firm performance. As such, to grow innovative enterprises, it can be beneficial to help enterprises in the creation, management and commercialisation of their IP and intangible assets.

Key Findings1

Our study found that, for local firms with positive revenues and profits, ownership of a portfolio of IPRs (i.e., patents, trade marks and registered designs) has led to higher revenues and profits for firms.

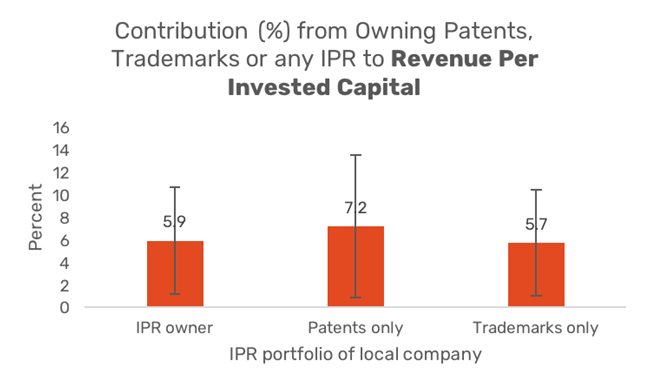

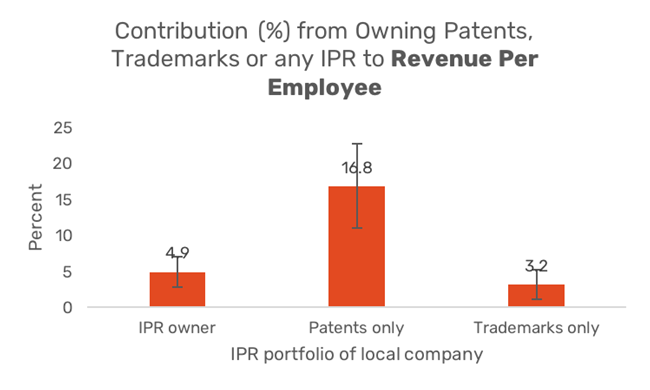

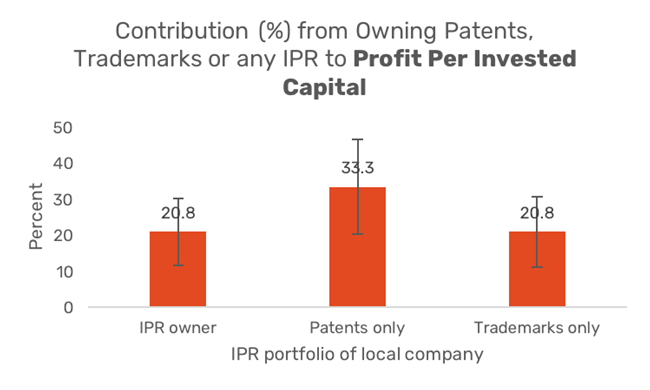

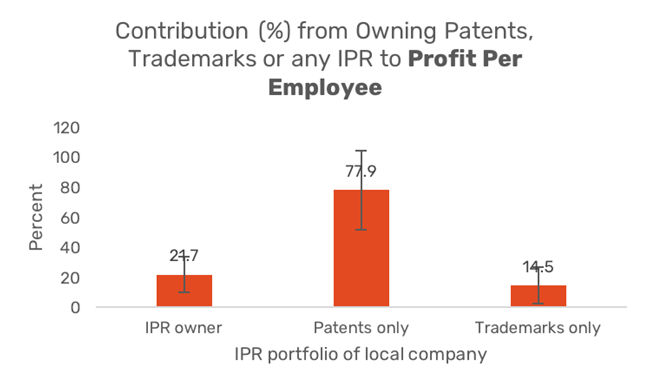

Between 2010 and 2022, IPR ownership2 (on average) has contributed to:

(i) 5.9% increase in revenue per invested capital per

annum,

(ii) 4.9% increase in revenue per employee per annum,

(iii) 20.8% increase in profit per invested capital per annum, and

(iv) 21.7% increase in profit per employee per annum.

View the full study here

1Black vertical lines in the figures represent 90% confidence intervals. The two main controls of inputs to firms’ revenues and profits are capital and labour.

2IPR ownership refers to ownership of at least one of any type of IP – patent, trademark, or design.