Singapore IP Survey 2021

The inaugural Singapore IP Survey was conducted to better understand enterprises’ perception and use of Intangible Assets and Intellectual Property (IA/IP).

On this page

The inaugural Singapore IP Survey was conducted by IPOS from February to May 2021 to better understand enterprises’ perception and use of intangible assets and intellectual property. Responses from 671 enterprises across the manufacturing, essential services, built environment, modern services, lifestyle and trade & connectivity industries were obtained.

The findings highlighted areas where enterprises can use IA/IP for growth.

The survey was conducted as part of the Singapore IP Strategy 2030’s thrust to support enterprises in creating, protecting, managing and commercialising their IA/IP assets.

Key findings

Enterprises' ability to use IA/IP for growth

Top IP activities

45% of enterprises engaged in IP commercialisation activities and the three most common activities were using IP in products and services, licensing IP and selling IP.

Did you know that you can generate revenue from IP?

Intangible assets account for more than 90% of business value (Ocean Tomo, Intangible Asset Market Value study, 2020). You can derive more value and drive your business growth with IP management.

Book a session with us to explore how you can protect and commercialise your IP.

Top IP types

More than 70% of enterprises stated that having or developing a strong brand and confidential information were important, with new technology or processes identified as the third most important type of IP.

IPOS Go Mobile’s Latest Feature, Brand Search

With the new all-in-one search function, it is easier to find that perfect brand name. You can search for existing business names, trade marks, web domains and social media usernames at one go.

Download the IPOS Go Mobile app on Google Play or the App Store now!

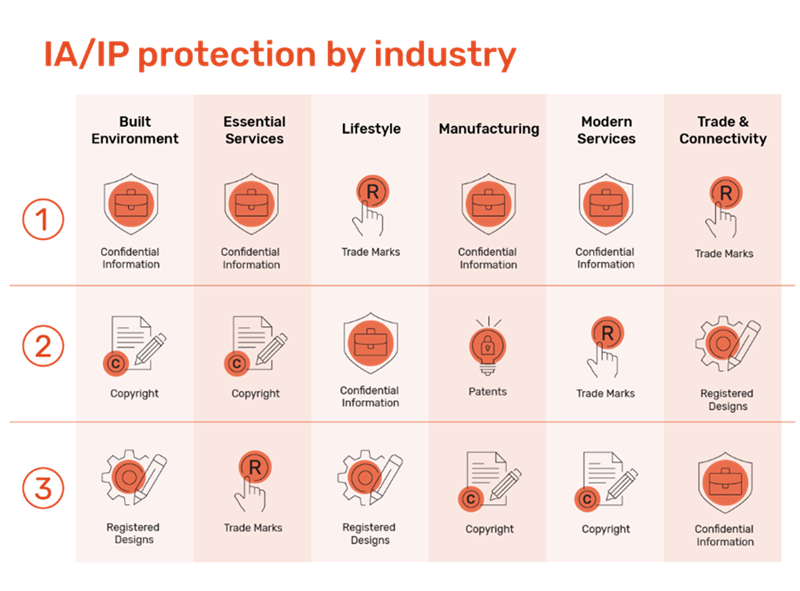

Across different industries, the key types of IP protection vary to capture relevant growth opportunities with IP.

How can you accelerate growth with IP?

These are the most important forms of IP protection for various industries to capture more opportunities and accelerate business growth with IA/IP awareness and management. Which industry are you in and how can you grow your business with IP?

Derive greater value from R&D investments and IA/IP management.

Support schemes for enterprises

While enterprises recognise the importance of IA/IP, there is a need to raise awareness of IP-related services and build IP knowledge. 95% of enterprises did not utilise grants, subsidies, or government funding for IP activities, citing a lack of awareness. Additionally, around half of enterprises felt that not having the expertise or knowledge to obtain IP protection was the biggest challenge.

Tap on these grants to help you fund your IP activities:

Enterprise Development Grant (EDG)

Funds up to 70% of the costs of a qualifying project by companies to upgrade their business, innovate or venture overseas.Market Readiness Assistance (MRA) Grant

Covers up to 70% of third-party costs, including IP search and applications costs incurred by companies taking their business overseas (capped at S$100,000 per company per new market).

Take a look at how the Enterprise Development Grant (EDG) helped to boost Barghest Building Performance’s (BBP) IP journey.

EDG Case Study - Barghest Building Performance (BBP)

BBP is an award-winning energy efficiency company that enables businesses to achieve their carbon neutrality and sustainability goals. Since 2012, BBP has enabled multiple blue-chip and Fortune 500 companies to achieve up to 40% energy and cost savings using patented HVAC optimisation technologies, Internet of Things (IoT), proprietary software algorithms, Artificial Intelligence (AI) and machine learning.

Leveraging government support

Supported by the Enterprise Development Grant (EDG) from Enterprise Singapore, BBP created patented technologies and used advanced data analytics to improve energy the efficiency of their clients’ chiller plants and equipment. This also allowed clients access to features like predictive maintenance, fault detection diagnostics, false alarm reduction and equipment life cycle extension of chiller plants and equipment.

IP journey

With IP management as part of their holistic business strategy, BBP’s patented technology gave them a competitive advantage and cemented their position as a leader in technology driven solutions for chiller plant energy efficiency.

"Supported by the Enterprise Development Grant (EDG) from Enterprise Singapore, BBP created patented technologies and used advanced data analytics to improve energy efficiency of chiller plants and equipment."

Singapore as an IA/IP hub

As a global IA/IP hub, 99% of enterprises found that IP services in Singapore were sufficient.

More than a quarter of enterprises had also sought to expand into, or had a presence, in other ASEAN countries. The main IP-related challenge that they faced, however, was the lack of expertise in obtaining international IP protection.

Go global with IPOS’ aceleration programmes

Patent Prosecution Highway (PPH) programme, accelerates patent applications in 30 markets, including Japan, the United States and Germany.

ASEAN Patent Examination Co-operation (ASPEC) expedites patent applications across nine participating offices in Southeast Asia.

From February 2022, the revamped IPOS Business Clinics will offer enterprises advice on IP matters related to internationalising.

Take a look at how OneConnect Financial Technology successfully leveraged Singapore’s international network for growth.

ASPEC Case Study - OneConnect Financial Technology

OneConnect Financial Technology Co., Ltd. is a leading technology-as-a-service platform provider enabling digital transformation for financial institutions. OneConnect offers a broad spectrum of innovative solutions in the financial industry providing end-to-end digital solutions for their international clients’ transformation journeys.

Incubated by Ping An, OneConnect embraces a strong culture of innovation with R&D infused into its DNA. OneConnect highly prioritises R&D, dedicating more than RMB 3.8 billion between 2017-2020. Recognising the importance of protecting its proprietary technologies and IP across markets in Southeast Asia, South Asia, UAE, Japan, South Korea, and Europe. As of September 30, 2021, the Company has submitted 5,229 global patent applications, including 1,300 overseas patent application (outside of China). In the future, OneConnect will continue to invest in developing its IP, continuously enhance its core technical capabilities, and accelerate the integration of technology in a wide range of scenarios to unleash transformation across the wider financial services sector.

In 2018, OneConnect set up its regional headquarters in Singapore to spearhead regional expansion and innovation. Singapore was chosen because of its strengths as a financial and innovation hub, its strategic position as a gateway to Asia and its robust IP regime. OneConnect has filed more than 50 technology patents in artificial intelligence, blockchain, and big data to support its business growth and R&D activities in the region.

“Singapore’s vision towards a global IP hub is well positioned to resonate with the rising importance for enterprises to grow, protect, and commercialise their innovations and IA as they scale and internationalise. OneConnect is committed to using its expertise in innovation and curating ecosystems with diverse and value-adding partners, including IP institutions like IPOS, for enterprises to forge mutually-beneficial collaborations, do business securely, and thrive symbiotically across geographies.”

- Tan Bin Ru, CEO (Southeast Asia),

OneConnect Financial Technology and Co-Chairwoman, Blockchain Association Singapore

IP jobs and skills

Many enterprises surveyed appreciated the additional value brought by an employee with IP skills, with almost 40% preferring to hire candidates with IP skills and 15% requiring employees with IP skills.

Develop your IP skills at the IP academy

Singapore’s only dedicated centre for IP education and training, IP Academy can help you to develop your team's IP capabilities.

Start your learning journey with IP Academy.

Here are the top three industries that required employees with IP skills, and the industries that preferred hiring candidates with IP skills:

With the global value of intangible assets rising at $65.7 trillion, we want to help enterprises manage your IA/IP and grow your business. Start your journey with us!